See the bottom of the page for a segment from MEKO’s Capital Markets Day 2025 on Exclusive Brands, presented by Henrik Pettersson, Director of Exclusive Brands at MEKO.

Demand for exclusive brands in the automotive industry is growing, as car owners increasingly seek high quality at a reasonable cost. Many want products that live up to the standards of well-known brands, but without the high price tag. To meet this need for affordable quality products, MEKO has launched a new division for the Group’s exclusive brands.

"This gives our customers an attractive alternative in both price and product range," says Henrik Pettersson, Director of Exclusive Brands at MEKO.

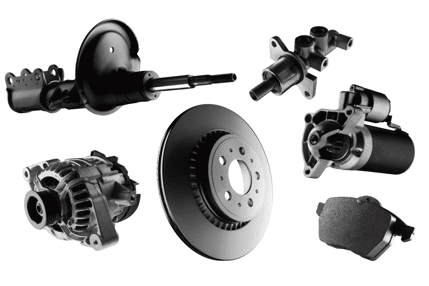

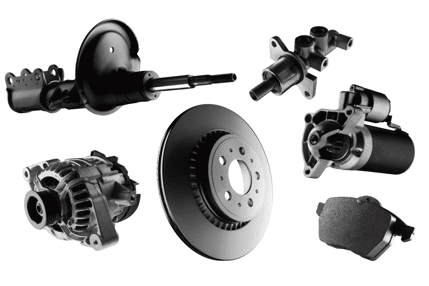

The new division includes MEKO’s exclusive brands in spare parts, lubricants, tools, and car accessories. Under a unified strategy, clear price segments and product portfolios are created to meet different customer needs.

Henrik Pettersson brings extensive experience from the automotive industry and has worked broadly in product development, brand strategies, and business development – particularly within the segments now in focus for MEKO.

"With our own brands, we can offer something unique that truly makes a difference for customers across all our markets. We can control the entire chain – from product development to distribution – which increases efficiency and strengthens our market position," Pettersson explains.

Workshops and car owners as the largest customer groups

MEKO’s exclusive brands, ProMeister Carwise, Every Part Matters, and Automec, primarily target the vehicle service sector, with workshops as their largest customer group. The products are also available to car owners, such as do-it-yourself customers looking for the right quality accessories.

By consolidating production, purchasing, and distribution, MEKO reduces the number of intermediaries and can offer competitive prices without compromising on quality.

"Our strength lies in always starting from the customer’s needs. By being present with competitive pricing and integrating parts of production and distribution, we can eliminate middlemen, which ultimately benefits the customer," says Pettersson.

Good. Better. Best. A versatile brand portfolio with products for every need

By developing products in-house and sourcing directly from manufacturers, MEKO creates its own brands that cover all segments and customer needs—delivering value across the entire chain for both workshops and car owners:

- For workshops, this means they can serve price-conscious customers without compromising their margins.

- For car owners, especially those with older vehicles, it offers affordable solutions without sacrificing quality or safety.

“The result is a clear win for everyone: profitability for MEKO, profitability for workshops, and cost-effective options for customers,” says Henrik Pettersson, Director of Exclusive Brands at MEKO. “Unlike many other players, MEKO can create its own brand identities and adapt products to meet both local and international requirements.”

The portfolio follows the Good–Better–Best model, enabling MEKO to meet diverse customer needs in each market. For example, in brakes, Sweden lacks the entry-level “Good” segment, while Poland has yet to introduce “Better.” The strategy is to fill these gaps so that every market benefits from a complete Good–Better–Best structure.

“Through joint purchasing and coordinated product development, MEKO leverages synergies across the Group. We can meet the competition from well-established brands by offering the same value, but at a more competitive price. This gives our customers an attractive alternative in both price and product range,” says Henrik Pettersson.

2028: SEK 3 billion, with strengthened customer loyalty and increased market share

The financial targets are clear and ambitious. By 2025, the goal is to achieve SEK 1.8 billion in revenue from MEKO’s own brands, with a target of SEK 3 billion by 2028 according to the strategy. This growth is expected to increase the share of revenue from proprietary brands, boost customer loyalty, and expand overall market share.

“Results in the local markets have so far been positive, with several initiatives implemented over the years. However, the potential of the Good–Better–Best structure has not yet been fully realized, and some gaps remain. To address this, a Group-wide framework for the four brands is being introduced, enabling greater operational efficiency and ensuring that customers are offered a balanced combination of quality, price, and availability,” says Henrik.

The division is envisioned as the Group’s central hub for purchasing, product development, and product strategy.